Mckinsey has released a long awaited (by me anyway) report on the future of work entitled A Future that Works: Automation, Employment, and Productivity. It is a very interesting look at the technologies which are affecting the future of human work. Every business and organisation should read it in full.

Mckinsey takes a distinctly different approach than the much discussed Frey and Osbourne Oxford report on the susceptibility of jobs to computerisation.

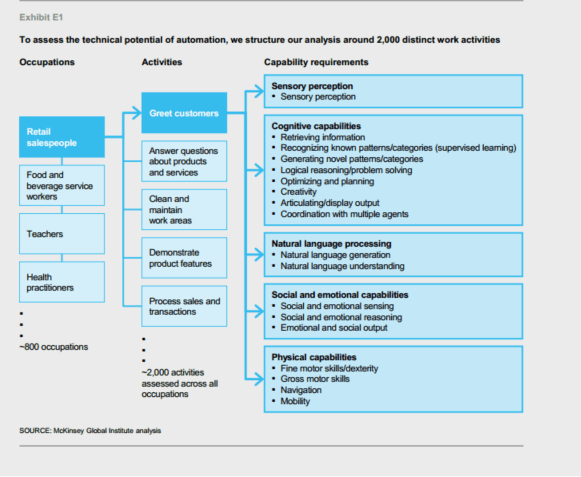

This difference can be best seen in the following graphic from the report:

Instead of looking at what jobs might be replaced the team at Mckinsey have examined all the activities that each job in the USA job market entails and then looked at the various capabilities for each of those activities. They have then mapped those activities against the possible timelines of those activities being able to be performed by technology.

This is important because except for very limited cases technology replaces activities rather than whole jobs.

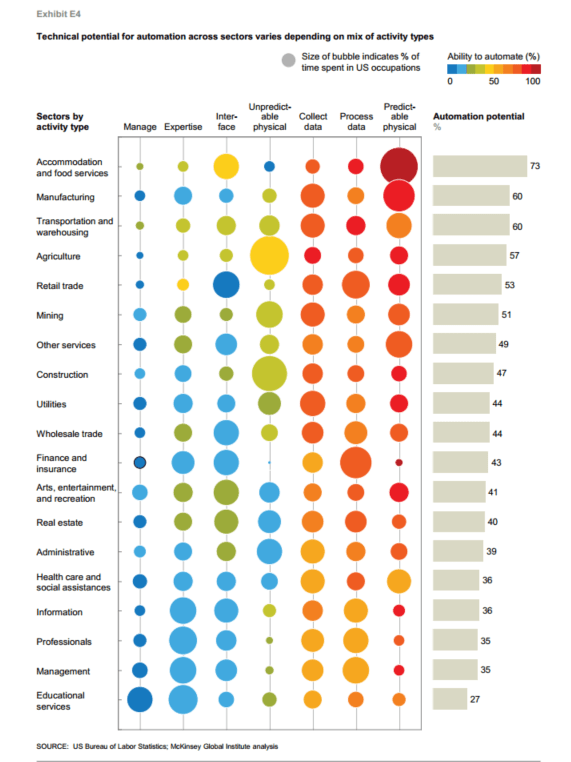

From this approach Mckinsey have created various forecasts for both the types of activities and the sectors of the economy as shown in the next graphic which shows their view about the ability to automate those activities.

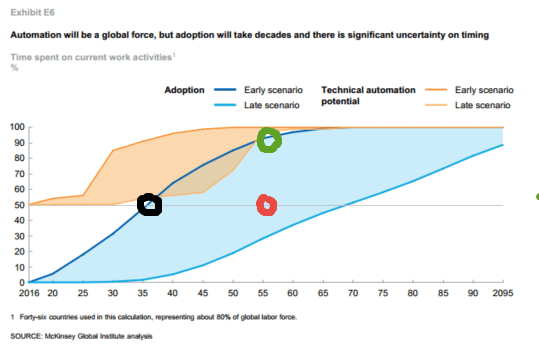

Taken in aggregate their predictions are shown in the next graphic which I have annotated

RED: Their median forecast that 50% of all current activities will be replaced by 2055

BLACK: The rapid adoption forecast that 50% of all activities will be replaced by 2035 (only 18 years away)

GREEN – The extrapolation of the rapid adoption forecast from 2035 that shows that over 90% of current activities will be replaced by 2055.

Mckinsey also states that:

“According to our analysis, fewer than 5 percent of occupations can be entirely automated using current technology. However, about 60 percent of occupations could have 30 percent or more of their constituent activities automated”

Apart from praising Mckinsey (which I do not normally do) for creating such detailed and interesting work, and also in highlighting the inherent uncertainty in any forecast, this raises several interesting questions in terms of impacts and change.

From an organisational perspective those questions include::

- Setting aside the changes the technology makes to our business models and speed of doing business if 20-50% of activities are going to be replaced over the next 18 years how are we going to lead our people through the continual change that is going to be required? If the average is 50% then many people will have far more of their activities replaced.

- If technology takes over more and more of non-routine activities in our organisation what are the skills we are going to need?

- If technology pushes people out of the lower skilled activities in the whole economy how many people in the whole community are capable of carrying out the higher skilled activities we will need our people to concentrate on? Will we be in an even fiercer fight to recruit the people we need?

An article in the New York Times on January 30th 2017 describes When the German engineering company Siemens Energy opened a gas turbine production plant in Charlotte, North Carolina:

some 10,000 people showed up at a job fair for 800 positions. But fewer than 15 percent of the applicants were able to pass a reading, writing and math screening test geared toward a ninth-grade education

Eric Spiegel, who recently retired as president and chief executive of Siemens U.S.A. said “People on the plant floor need to be much more skilled than they were in the past. There are no jobs for high school graduates at Siemens today.”

From a societal point of view this raises questions of:

- Are we heading into a period of increasing structural unemployment?

- How will we design an education/learning system which gives your young people the skills they need to work in the changed economy and our post school/university people the capacity to re-skill?

- If education is changing to be more focused on re-skilling people for jobs how do we still supply the wider general benefits of education?

Part of the answer to the second question is contained in the New York Times article where it describes the companies getting heavily involved in educating and training people with guaranteed jobs at the end of the cycle, and just as importantly no student loan debt. This was mirrored in my conversation in a trip to Austin Texas last year. Austin is growing at an enormous rate and part of the reason is that some of the major tech companies have realised that if they do not get involved with students before they graduate they may never get to hire them. So they are moving major parts of their operations closer to the Universities with strong reputations in the skills they need. University of Texas Austin happens to be one of those. Students are becoming heavily involved and supported by the companies.

When I work with clients on these issues they should be focused on the effects on their business or their organisation but the conversation always turns to the wider implications for society.

The techno-optimist argument is that technology has been destroying human jobs for hundreds of years and we have always created new ones. That is partly because we have created new capabilities that need people, but also because we have reduced the costs of inputs to make otherwise uneconomic business models viable. Mckinsey argues in their report that their median forecast results in job losses that have already been experienced in society as we reduced the human employment levels in agriculture, and then again in manufacturing. This is true if the pace remains the same.

On top of that they argue that the productivity improvements are required because we are losing the huge contribution that population growth rates have contributed to economic growth over the last 100 years. That is a good argument.

It is a brave futurist who says this time is different and it is completely plausible that the combination of new jobs being created, and the demographic change we are experiencing, particularly in developed economies will mean that we will still have close to full employment. It is also plausible that:

- The pace of change will be at the rate that fulfills the rapid adoption scenario that Mckinsey has envisaged, increasing the rate of job losses above previous experience.

- That as technology pushes people out of a whole range of human capability jobs we will find that a significant minority of people do not have the ability to carry out the jobs that are created.

- That a significant group of people that have the abilities will be left behind because they cannot gain the skills required to harness those abilities.

- That the combination of the two groups will either have to work for very low wages in order to not be replaced by technology or be permanently unemployed.

That is a recipe for societal unrest way beyond what we have seen in the rise of Donald Trump and Marie Le Pen. If the political response to the issues of the people that have expressed their frustration at the current system is to promise a greater share of the benefits of the economy and a genuine attempt to do that is derailed because of technology changes we could be in for a very bumpy ride indeed.

Amazon Dash is a programmable button that you can put in your house. The example here is one of putting one on your washing machine so that when you run out of washing powder you just push the button and washing powder is delivered into your house. It takes all the friction out of buying and I imagine them building in services integrated with Alexa (the interactive home system) so that rather than just buying your normal brand the system can queue up order requests and talk to you about special offers, etc at your convenience. Once adoption gets high enough then Amazon can use its considerable logistics and information system to package up multiple orders, supply weekly orders based on your usage, and give you special offers. It has not really caught on yet but the system is adding more and more brands and Amazon is pushing it out to more countries (

Amazon Dash is a programmable button that you can put in your house. The example here is one of putting one on your washing machine so that when you run out of washing powder you just push the button and washing powder is delivered into your house. It takes all the friction out of buying and I imagine them building in services integrated with Alexa (the interactive home system) so that rather than just buying your normal brand the system can queue up order requests and talk to you about special offers, etc at your convenience. Once adoption gets high enough then Amazon can use its considerable logistics and information system to package up multiple orders, supply weekly orders based on your usage, and give you special offers. It has not really caught on yet but the system is adding more and more brands and Amazon is pushing it out to more countries (